are nursing home fees tax deductible in uk

You can claim this relief at your highest rate of income tax if the nursing home provides 24-hour on-site nursing care. FNC is a fixed amount each week which is paid to the nursing home.

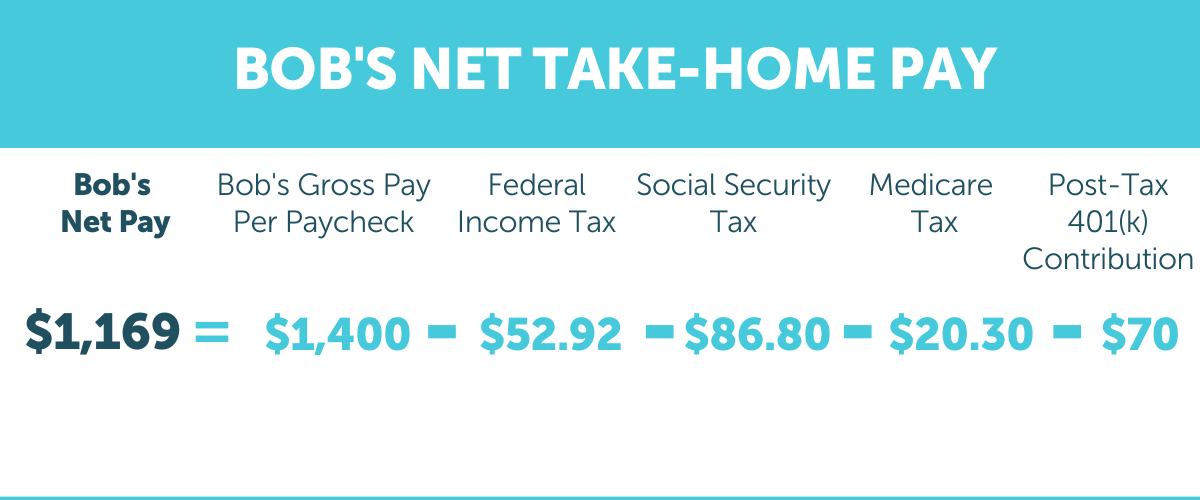

What Is A Pre Tax Deduction A Simple Guide To Payroll Deductions For Small Business

As already said it is taxable.

. How much you can claim will depend on a number of factors including how much your annual fees cost and your tax situation. Free Provider Shortlist Free Expert Advice Online on the Phone. Do Existing Tax Incentives Increase Homeownership Tax Policy Center.

You claim tax relief for nursing home fees under the general scheme for tax relief on medical expenses. Are nursing home fees tax deductible in UK. You claim tax relief for nursing home fees under the general scheme for tax relief on medical expenses.

Should he receive medical care while residing in the home you can claim those costs as a deductible expense along with any nursing services that might be provided. The Master List Of All. If you are paying the nursing home fees you can get the tax relief.

We are here to help. To qualify for this tax break. Mar 7 2012.

However a 91-year old has a tax-free personal allowance of 10660 in the coming tax year so without knowing his exact. The NHS will pay a flat rate contribution directly to the care home towards the cost of the nursing care. You can claim this relief at your highest rate of.

If you your spouse or your dependent is in a nursing home primarily for medical. As a guide members who pay basic rate Tax in the UK can. If a single person is forced to go into a care home but because her home is worth 200000 she will receive no support to pay her care.

Medical expenses are deductible under the general scheme for tax relief and nursing home fees are eligible. Nursing home expenses. In most cases out-of-pocket nursing home costs are generally tax.

Are care home fees deductible. Yes in certain instances nursing home expenses are deductible medical expenses. If you are paying the nursing home fees you can get the tax relief whether you are in the nursing home yourself or you are paying for another person to be there.

You can claim this relief as a deduction from your total income if the. If you are seeking to deduct the costs of a nursing home or assisted living facility you might be able to deduct anything that exceeds 75 of your income. Providing care for a loved.

Up to 15 cash back Unfortunately no tax relief is available for privately funded nursing home fees. You may claim Income Tax IT relief on nursing home expenses paid by you. HM Revenue and Customs HMRC allow individuals to claim tax relief on professional subscriptions or fees which have to be paid in order to carry.

Certain home care services youve paid for yourself your spouse or another dependent can qualify as a deductible expense on your taxes. Claiming tax relief on your registration fee. Tax relief on nursing home fees.

If you DO join the scheme any excess income above. If you live in England and Northern Ireland and have assets of. Find Care Homes near you.

Are nursing home fees tax deductible in uk Wednesday March 9 2022 Edit. Ad The most detailed elderly Care Directory in the UK. I have to pay a top-up of 153 a week for my mothers care home feesIs there any way that I can offset this cost against my income tax bill.

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

The Master List Of All Types Of Tax Deductions Infographic Business Tax Deductions Small Business Tax Business Tax

Can I Get A Student Loan Tax Deduction The Turbotax Blog

75 Items You May Be Able To Deduct From Your Taxes

Teacher Tax Deductions Teacher Organization Teaching

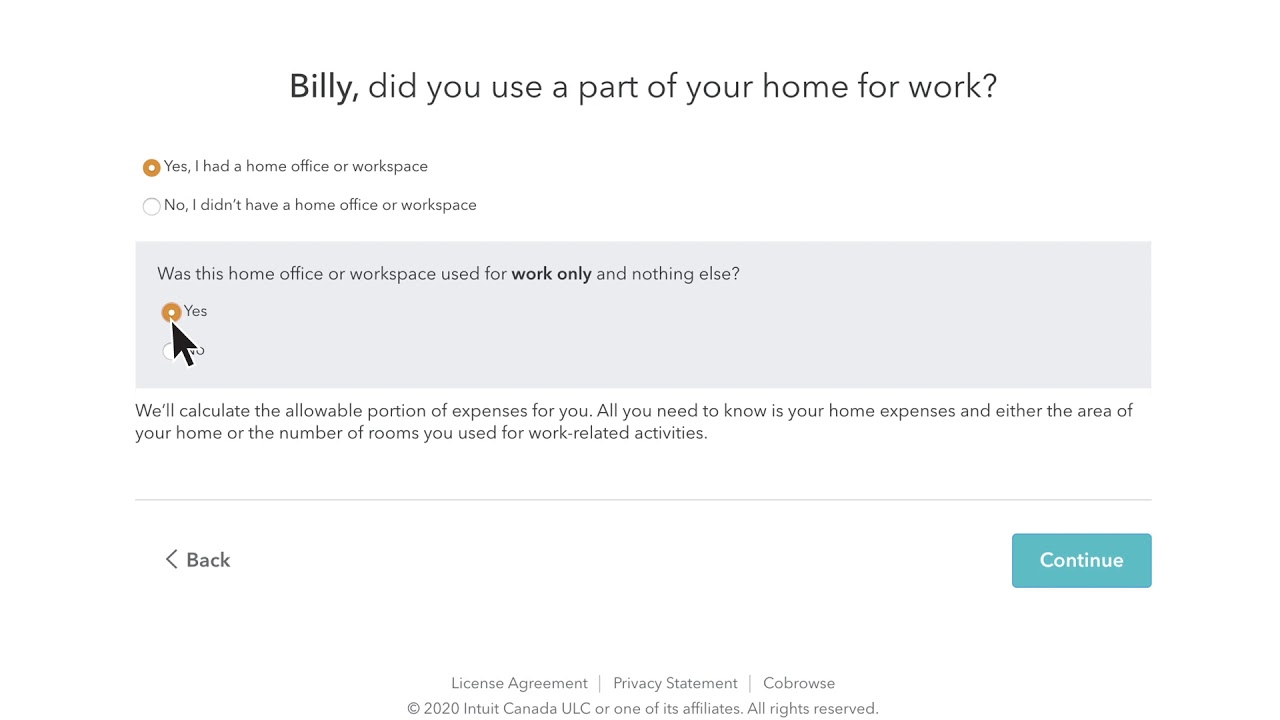

Home Office Deductions For Self Employed And Employed Taxpayers 2022 Turbotax Canada Tips

Canadian Tax Return Check List Via H R Block Ca Http Www Hrblock Ca Documents Tax Return Do Small Business Tax Deductions Tax Prep Checklist Business Tax

The Ultimate Self Employed Deduction Cheat Sheet Exceptional Tax Services Small Business Tax Deductions Business Tax Deductions Tax Services

Income And Expense Statement Template Beautiful Monthly In E Statement Template And Ex Business Worksheet Small Business Tax Deductions Business Tax Deductions

Ebitda Stands For Earnings Before Interest Tax Depreciation And Amortisation It Is A Profitability Kpi C Finance Blog Small Business Accounting Finance Advice

Home Office Deductions For Self Employed And Employed Taxpayers 2022 Turbotax Canada Tips

Super Helpful List Of Business Expense Categories For Small Businesses Based On The Sc Small Business Bookkeeping Small Business Tax Small Business Accounting

Filing Your Tax Return Don T Forget These Credits Deductions National Globalnews Ca Small Business Tax Business Tax Bookkeeping Business

20 Overlooked Unusual Tax Deductions You May Be Eligible For Tax Deductions Small Business Tax Deductions Business Tax Deductions